Five dollars walks in the door and goes on the sheet. Just as the name implies, cash accounting is a basically a history of your business as told by the cash you’ve taken in. The toy store is using cash-basis accounting, sometimes just called cash accounting. The problem is, we have a cost that should be linked to revenue. If we recognized revenue like the toy store owner, we wouldn’t have any revenue until the bill was paid. You don’t have any money, but you have a cost – your time.

Now, you’ve spent the time to fix the pipe and given them a bill for $50. There are some cost concerns, but let’s assume it’s really just a loose pipe that can be fixed with a wrench. You spend the morning fixing a leaky pipe for a customer, charging them $50. Now, imagine a slightly different scenario. As soon as you sell the toy, the asset is gone, the cash appears, and your revenue goes from $0 to $50. When someone comes in to buy the toy car, they give you $50 and take the toy. You start the day with a $50 asset in hand and, therefore, on your balance sheet (a toy car, let’s say) and $0 in revenue. Pretend you own a simple and pleasant toy store, instead of a place where people go to not die. I know you want to learn about healthcare transactions, but let’s start with some simpler businesses to illustrate the difference between cash and accrual accounting. In the world of accounting, you have a couple of options when it comes to recognizing revenue and costs. From the very start, you can make this small change and set yourself up for big success down the line. Now replace the pages with, I don’t know, moth wings.Īlthough the whole field is specialty unto itself, today we’re going to focus in on one small part that affects many small providers – choosing an accounting system. Now have that book published only in Sanskrit. Imagine someone gave the IRS the job of writing a medical textbook. BettnerĪrticle: Accrual Accounting Concept in IFRS and GAAP by Finance Train.Healthcare accounting is like everything else in the sector – confusing, bureaucratic, and riddled with nonsense. Let's see a demonstration in the following table.īook: Principles of Accounting Volume 1 - Financial Accounting (2019) by Mitchell Franklin, Patty Graybeal, Dixon Cooperīook: Accounting: The basis for business decisions - 11th edition by Robert F. Only the used portion of the insurance will be matched with the income of the year. Because the entire insurance policy has not been used in the year 2020. At the year-end (so December 2020), the company earned €100.000.Īlthough the company purchased an insurance policy for 12 months in 2020, it will report the insurance policy used for 7 months in the income statement. FAS 109 (Accounting for income taxes) and IAS 12 (Income taxes) requires accounting for taxable income.Īssume that ABC Company has purchased an insurance policy of €1200 for a year on the June 5th, 2020. the matching of tax expense with the taxable income of the specific period that sometimes results in little differences and creates deferred taxes.It requires matching the manufacturing or inventory cost of the product with the revenue of the financial period when it is sold. The recognition of the cost of goods sold under the revenue earned in a specific financial period.The recognition of depreciation of the property, plant, and equipment with the revenue of the period in which they are utilized for generating revenue.The deferrals of prepaid expenses and accrued expenses are charged to the revenue of the current period.Some of the applications of the matching principle in accounting are listed below: The principle states that "all the expenses incurred in a specific time period must be recognized in the income statement of that time period in which the income is earned". We might say that the concept of accrual accounting stems from the matching principle. It helps shareholders, creditors, and other stakeholders to understand and predict the company's financial performance. Because it provides a clear and accurate view of the business operations and revenue earned of the company.

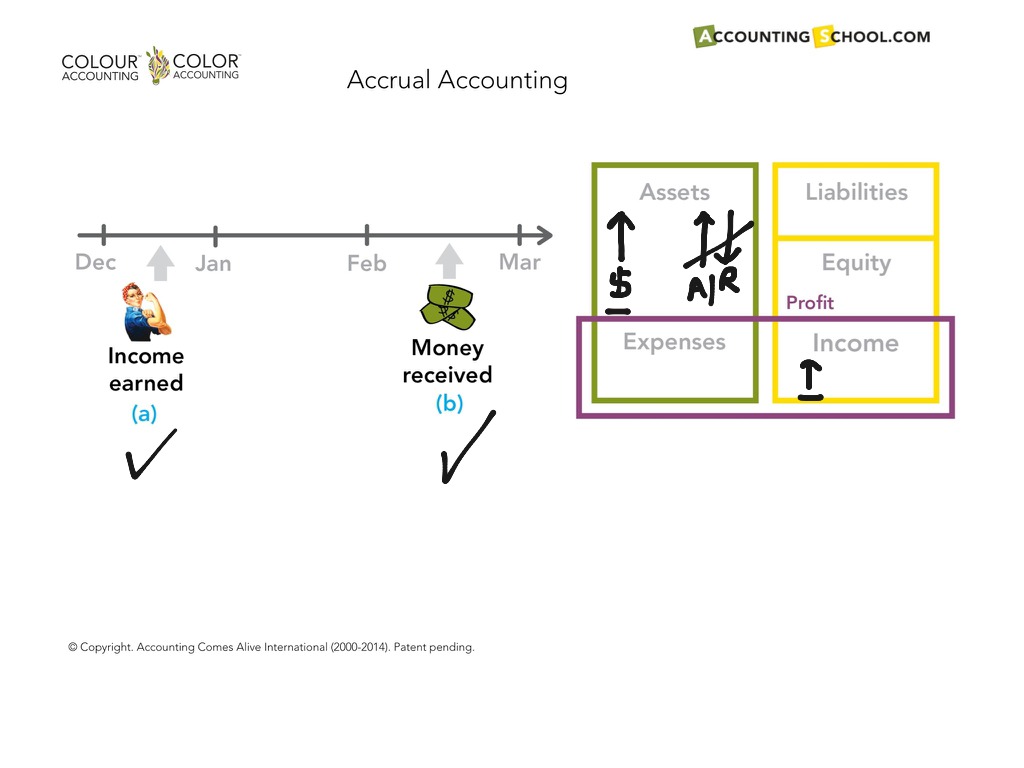

Both of the accounting guidelines IFRS and GAAP recommend accrual accounting to record the revenue and expense of an organization. The accrual accounting concept recognizes income at the time when it is earned and recognizes the expense when it is incurred used, or consumed. The matching principle is one of the fundamental concepts of accrual accounting. It requires to match the costs incurred in a specific time period with the revenue of that time period. The concept of matching in accounting and finance is based on the relationship of the revenue and expense that demonstrate the cause and effect relationship between them.

0 kommentar(er)

0 kommentar(er)